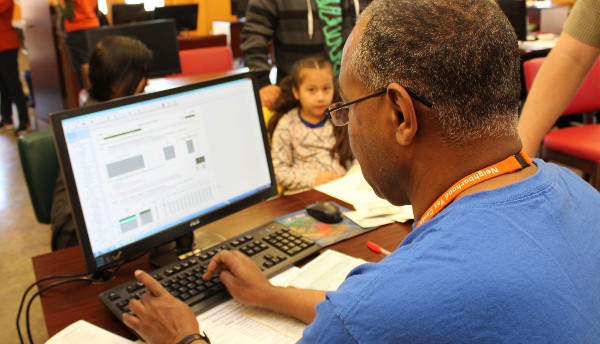

IRS-certified preparers assist families and individuals earning up to $58,000, helping them retain every dollar of their refund and saving the average $200 cost of professional tax preparation services.

According to them, the word “free” is used by many paid preparers, clients are often subject to staggering interest rates on predatory loans offered as “refund advances.” With the recent announcement by the IRS that taxpayers claiming the Earned Income and Additional Child Tax Credits will have their refund delayed, there is an increased risk of losing hard-earned money to these refund advances.

“Our free tax preparation services are intended to increase family financial stability and enable hardworking families to use their entire tax refund for important things like paying for basic needs, covering their children’s school expenses or saving for a rainy day,” said Jose Perez, director of Neighborhood Centers Program.

Important documents that taxpayers must bring include:

Photo ID, Social Security cards or ITIN letters for everyone on the tax return

Proof of income (W2, 1099, etc.)

1095 form: Health coverage statement

Check with bank account and routing number for direct deposit of your refund

For more information on location and hours for Free Tax Prep, visit www.freetaxcenters.org or call the 2-1-1 Texas/United Way HELPLINE.

For more resources for Houston parents, go HERE!

Leave a Reply